The best way to pay for new salon or spa equipment depends on your current financial situation and long-term goals.

- Paying up front is often better when you have strong cash reserves and want to avoid extra costs.

- Financing is often better when you want to preserve working capital for day-to-day needs or make top-quality equipment more accessible.

The decision comes down to a balance between protecting short-term cash flow (financing) and minimizing long-term cost (cash). Let’s look at both sides with real-world examples.

Paying Cash for Salon Equipment: Benefits & Risks

Buying equipment outright will get you the best price in the long run, as long as it doesn’t leave your business short on working capital.

Benefits of paying cash

- No interest or fees: You only pay the purchase price.

- Simpler bookkeeping: No loan statements, late fees, or monthly payment reminders.

- More assets on your books: Your equipment becomes an immediate business asset.

- Lowest total cost: No time or money spent managing debt.

Example: A barber pays in full for a $1,200 professional barber chair. In this case, buying outright keeps things simple without turning a quick upgrade into months of payments.

Risks of paying cash

- Drains liquidity: If you use $15,000 in savings for new pedicure chairs, will you still have enough for technician payroll, rent, and supplies next month?

- Less of a safety net: Slow spells, higher-than-expected utility bills, or emergencies could leave you scrambling.

Salon Equipment Financing: Pros, Cons & Real-World Examples

Financing lets you spread out costs over time, which makes big-ticket purchases easier to manage without draining your reserves.

Benefits of financing

- Protects working capital: Payment plans let you keep more cash on hand for payroll, marketing, inventory, and other ongoing expenses.

- Affordable access to quality: Instead of compromising, you can invest in the equipment you really need and enhance your brand reputation.

- Possible tax advantages: With Section 179, you may deduct the full cost of qualifying equipment even if you finance it (double-check with your accountant).

- Builds business credit: On-time payments establish and strengthen your credit history.

- Speed and flexibility: Financing lets you replace broken equipment quickly or scale up as demand increases.

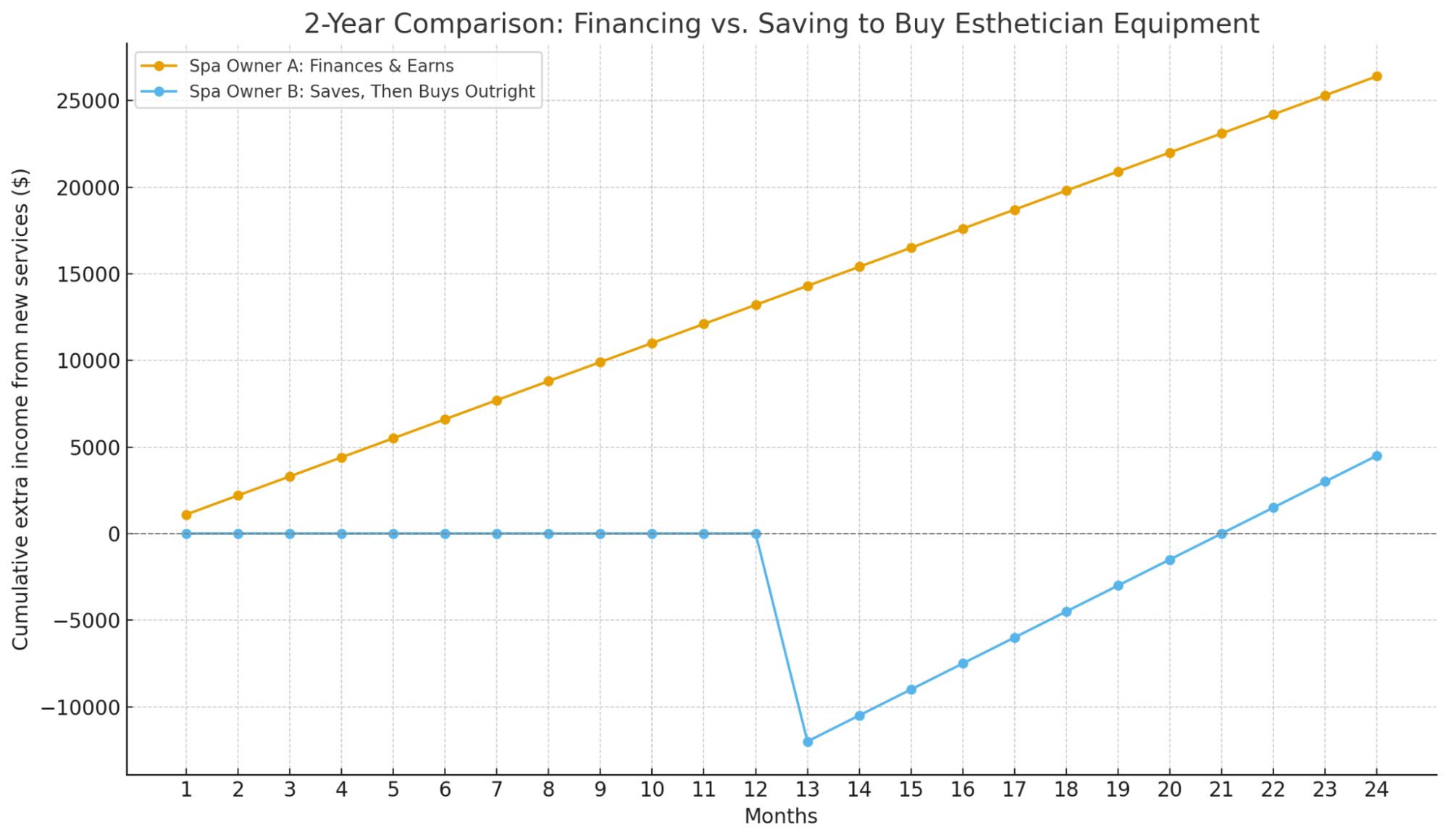

Example: A spa owner finances $12,000 in esthetician equipment. Payments run $400/month, but the new treatments bring in $1,500/month. Waiting to save up the cash would mean losing $1,100 in revenue every month.

In this example, Spa Owner A finances $12,000 in equipment and starts earning on new services right away, adding $1,100 net income each month (after covering the $400/month installments). Spa Owner B waits a year to save up and pay cash for the new equipment, missing out on $13,200 in potential new income in the time they waited to buy outright.

Risks of financing

- Higher total cost: With interest, you’ll pay more than the sticker price.

- Late fees and credit risks: Missed payments can hurt your business credit and future financing options.

- Commitment: Once you take on payments, you’re locked in until it’s paid off.

Salon Equipment Financing vs Paying Outright: Key questions to guide your decision

Here are some clarifying questions to help you decide whether cash or financing works better in your situation:

How’s your cash flow?

Can you pay outright without putting your reserves at risk? Think about ongoing expenses, emergencies, and potential growth opportunities.

Do you need to build credit?

For newer businesses, financing responsibly can help establish your credit history.

How big is the purchase?

Paying up front usually works best for smaller items, like technician stools or manicure tables. Financing usually makes more sense for remodels or investing in several new treatment tables for a spa.

How urgent is the need?

If the upgrade you have in mind is more of a “nice to have,” it may be financially savvier to save up and pay in full. But a broken shampoo bowl that forces you to cancel appointments can cost you revenue and damage client trust, so it makes sense to use financing to get back to business faster.

Do you qualify for good terms?

Check the requirements for credit scores, down payments, and interest rates. Not all financing offers are equal.

Can you afford the payments?

Carefully read the financing terms, crunch the numbers, and figure out how much you’ll be responsible for, including the down payment and monthly installments. Be honest about whether your revenue comfortably covers the purchase.

Have you spoken with a professional?

An accountant, tax professional, or financial advisor can put the numbers into context for your business. They can clarify how interest, fees, and tax deductions apply, forecast the impact on your cash flow, and help you plan for long-term stability and growth.

Do you understand your financing options?

Common financing options for small and medium-sized businesses include loans from local banks or credit unions, online business loans from non-bank financial companies, and SBA loans from the U.S. Small Business Administration.

Point-of-sale financing is also available on some e-commerce websites, which lets you apply and get approved for a payment plan at checkout. On-site financing through Klarna will be your fastest option, as approval is reached in seconds as you go through checkout, with no hard credit check.

The Bottom Line: Paying Cash for Salon Equipment vs. Financing

When it comes to the best way to pay for new salon or spa equipment, there’s no universal “right answer.” It depends on your cash flow, goals, and tolerance for debt.

- If you’re new, growing, or need to preserve liquidity, financing gives you flexibility and access to better equipment without tying up your cash.

- If your business is stable with strong cash reserves, paying outright may save you money long-term and minimize your monthly financial to-do list.

Whichever one you choose, it’s worth working with real numbers first. Run projections on how the new equipment will support revenue and growth, then review your plan with a financial professional.

How Minerva Beauty Can Help

No matter how you decide to pay, Minerva Beauty makes it simple. We offer financing through two trusted partners—Klarna and Brickhouse Capital—so you can choose what works best for your business. Here’s how each one works:

- Klarna: Ideal for purchases between $150 - $20K. Apply at checkout and get an instant decision!

- Brickhouse Capital: Offers equipment leasing for orders of $7500 or more. Apply with a simple, one-page application and get approval and funding in hours! Financing from Brickhouse Capital can also help cover buildout costs.

Minerva Beauty has a large in-stock inventory of salon and spa equipment ready to ship in 24-48 hours. Our customer service team offers more than support – we're your partner in building a salon you're proud of.

Contact our team today to get personalized guidance, exclusive package savings, and expert help with every step of your purchase.

Frequently Asked Questions

Is it better to pay cash or finance salon equipment?

It depends on your situation. Paying upfront avoids interest and keeps things simple, but financing preserves cash for payroll, supplies, and growth. Both approaches can be smart depending on your goals and cash reserves.

Does financing salon equipment cost more in the long run?

Yes, financing typically costs more overall because of interest and fees. However, many businesses find the extra cost is worthwhile since they can start earning revenue right away instead of waiting to save and buy outright.

Can I deduct financed salon equipment on my business taxes?

In many cases, yes. Under Section 179, you may be able to deduct the full purchase price of qualifying equipment even if you finance it. Always check with your accountant to confirm what applies to your business.

What credit score do I need to finance salon equipment?

Credit requirements vary by lender. In general, a stronger credit score will help you qualify for better terms. If your credit is average or lower, you may still qualify but might face higher rates or additional requirements.

What financing options are available through Minerva?

Minerva partners with Klarna and Brickhouse Capital to provide flexible financing. These options are designed to make professional salon and spa equipment more accessible, whether you’re buying a single piece or outfitting an entire space.

How fast can I get approved for Minerva’s financing?

With Klarna, you can apply at checkout and get an instant decision! If you’re applying with Brickhouse Capital, there’s a single-page application to fill out, and in most cases, you’ll get a decision within 24 hours.